Последняя версия

Версия

1.5.9

1.5.9

Апдейт

декабрь 26, 2024

декабрь 26, 2024

Разработчик

U.S. Bank Mobile

U.S. Bank Mobile

Категории

Финансы

Финансы

Платформы

Android Apps

Android Apps

Загрузки

0

0

Лицензия

Бесплатно

Бесплатно

Название пакета

com.usbank.SinglePoint

com.usbank.SinglePoint

Репорт

Сообщить о проблеме

Сообщить о проблеме

Подробнее о Mobile SinglePoint

If you are a U.S. Bank corporate or business client, you can use Mobile SinglePoint to access your time-critical SinglePoint and SinglePoint Essentials services on the go. With the Mobile SinglePoint app, you can optimize your working capital while maintaining oversight of critical banking functions.

With Mobile SinglePoint, you can:

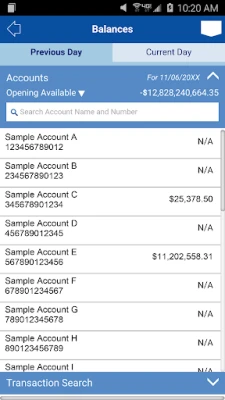

• View current and previous day balances or search for transactions within the Information Reporting database.

• Transfer funds between DDA accounts, loan accounts and trust accounts.

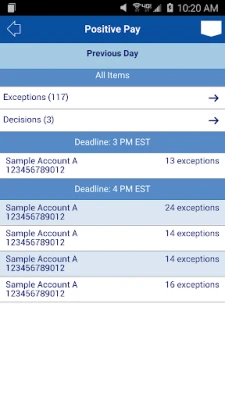

• Use Positive Pay; a check fraud tool that helps you make pay or return decisions quickly and confidently. You can also review exceptions for multiple accounts and view check images of exceptions.

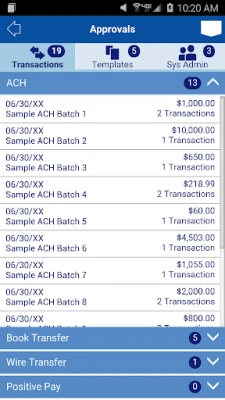

• Approve ACH batches and templates, wire transfers, wire transfer templates, and repeat codes; book transfers, and book templates. You can also approve Positive Pay decisions.

• Review bank messages quickly and conveniently.

System administrators

Approve password resets and control access to Mobile SinglePoint. The services, accounts and access entitlements each user has on SinglePoint or SinglePoint Essentials determines which functions are available through Mobile SinglePoint.

Please note:

The Mobile SinglePoint app is free to download. Your mobile carrier may charge access fees depending upon your individual plan. Web access is needed to use the mobile app. Check with your carrier for specific fees and charges. The Mobile SinglePoint app requires Android version 4.4 or later.

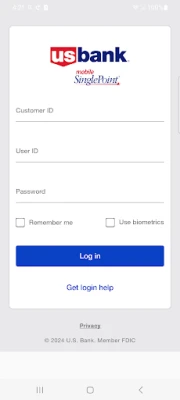

U.S. Bank is committed to protecting your security. Sensitive account information including your username and password are never stored on your mobile device and secure encryption is used to protect all transactions.

For personal banking, search for U.S. Bank in the App Store; Mobile SinglePoint® is designed for business clients only. You must be a SinglePoint® or SinglePoint® Essentials client to use this mobile application. Before using this application, your system administrator must assign the mobile entitlement to you. For more information about Mobile SinglePoint, contact a U.S. Bank Treasury Management Consultant or send a request to TreasuryManagementSolutions@USBank.com to locate a consultant in your area.

• View current and previous day balances or search for transactions within the Information Reporting database.

• Transfer funds between DDA accounts, loan accounts and trust accounts.

• Use Positive Pay; a check fraud tool that helps you make pay or return decisions quickly and confidently. You can also review exceptions for multiple accounts and view check images of exceptions.

• Approve ACH batches and templates, wire transfers, wire transfer templates, and repeat codes; book transfers, and book templates. You can also approve Positive Pay decisions.

• Review bank messages quickly and conveniently.

System administrators

Approve password resets and control access to Mobile SinglePoint. The services, accounts and access entitlements each user has on SinglePoint or SinglePoint Essentials determines which functions are available through Mobile SinglePoint.

Please note:

The Mobile SinglePoint app is free to download. Your mobile carrier may charge access fees depending upon your individual plan. Web access is needed to use the mobile app. Check with your carrier for specific fees and charges. The Mobile SinglePoint app requires Android version 4.4 or later.

U.S. Bank is committed to protecting your security. Sensitive account information including your username and password are never stored on your mobile device and secure encryption is used to protect all transactions.

For personal banking, search for U.S. Bank in the App Store; Mobile SinglePoint® is designed for business clients only. You must be a SinglePoint® or SinglePoint® Essentials client to use this mobile application. Before using this application, your system administrator must assign the mobile entitlement to you. For more information about Mobile SinglePoint, contact a U.S. Bank Treasury Management Consultant or send a request to TreasuryManagementSolutions@USBank.com to locate a consultant in your area.

Оцените приложение

Добавить комментарий и отзыв

Отзывы пользователей

Основано на 0 reviews

Отзывов пока не добавлено.

Комментарии не будут допущены к публикации, если они являются спамом, оскорбительными, не по теме, содержат ненормативную лексику, содержат личные выпады или разжигают ненависть любого рода.

Ещё »

Популярные приложения!

MarinaСорокин Дмитрий Олегович (@sorydima)

Marina for HUAWEIСорокин Дмитрий Олегович (@sorydima)

MarinaСорокин Дмитрий Олегович (@sorydima)

REChain ®️ 🪐Сорокин Дмитрий Олегович (@sorydima)

Katya ® 👽Сорокин Дмитрий Олегович (@sorydima)

Катя ® 👽Сорокин Дмитрий Олегович (@sorydima)

🎨 Катерина - Профессионал. 🙆Сорокин Дмитрий Олегович (@sorydima)

Катя ® 👽Сорокин Дмитрий Олегович (@sorydima)

REChain ®️ 🪐Сорокин Дмитрий Олегович (@sorydima)

REChain ®️ 🪐Сорокин Дмитрий Олегович (@sorydima)

Ещё »

Выбор редактора

PWA Modus PoS Pro SaaSСорокин Дмитрий Олегович (@sorydima)

Modus PoS Pro SaaSСорокин Дмитрий Олегович (@sorydima)

Marina for HUAWEIСорокин Дмитрий Олегович (@sorydima)

MarinaСорокин Дмитрий Олегович (@sorydima)

Катя ® 👽Сорокин Дмитрий Олегович (@sorydima)

Темпо (Tap Tempo)Сорокин Дмитрий Олегович (@sorydima)

Поросёночек для хозяина!Сорокин Дмитрий Олегович

Поросёночек для специалиста!Сорокин Дмитрий Олегович

Поросёночек для хозяинаСорокин Дмитрий Олегович (@sorydima)

Поросёночек для специалиста!Сорокин Дмитрий Олегович (@sorydima)

Web PWA

Web PWA HARMONY OS

HARMONY OS ОС Аврора

ОС Аврора Polkadot

Polkadot Ethereum

Ethereum BNB

BNB Base Blockchain

Base Blockchain Polygon

Polygon Gnosis

Gnosis Arbitrum

Arbitrum Linea

Linea Moonbeam

Moonbeam Aptos

Aptos Solana

Solana